how much are payroll taxes in colorado

Payroll tax is 153 of an employees gross taxable wages. Register your company as an employer.

Payroll Tax Requirements And Forms Colorado Business Resource Book

0 cents per gallon.

. 63 flat rateSales tax. No state-level payroll tax. In contrast to the tax-exempt organization however the employees must abide by local and federal tax laws regarding any income they make.

Yes colorados personal income tax is a flat tax system. Taxes in ColoradoColorado State Tax Quick FactsIncome tax. All Colorado employers must also pay state unemployment insurance tax.

We wont get stuck in the details here but you can find more in. The first 10000 in wages paid to each employee during every calendar year is subject to state unemployment. Total Employer Tax Expense.

What is the income tax rate in Colorado. In Sheridan youll be taxed 3 per month regardless of your wages. The state income tax in Colorado is assessed at a flat rate of 463 which means that everyone in Colorado pays that same rate regardless of their income level.

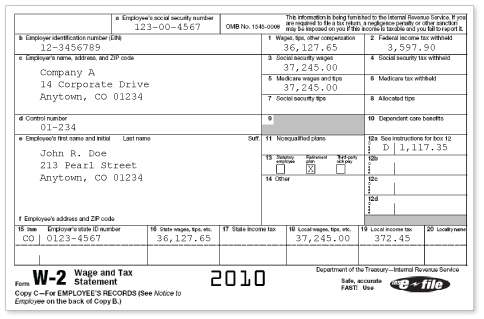

The federal income tax is the biggest tax of them all. No standard deductions and exemptions. Calculate your Colorado net pay or take home pay by entering your pay information W4 and Colorado state W4 information.

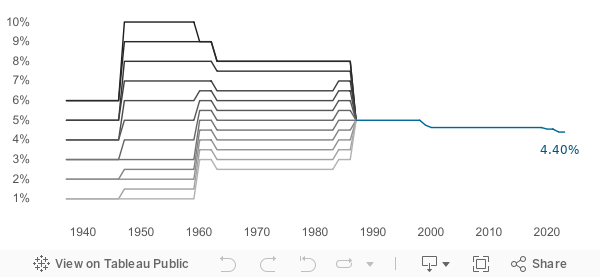

Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Colorado. For employers with very little payroll tax obligation less than 2500 a quarter deposits can be made quarterly with the 941 tax return. The state income tax rate in Colorado is under 5 while federal income tax rates range from 10 to 37 depending on your income.

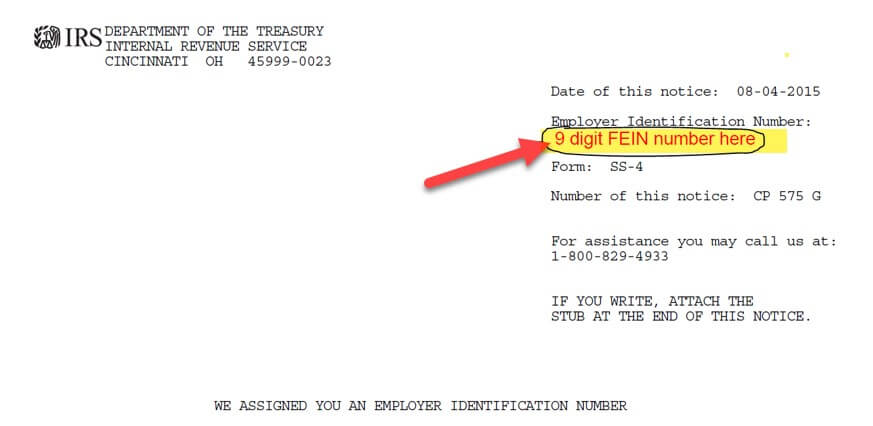

In total Social Security is 124 and Medicare is 29 but the taxes are split evenly between both employee and. Obtain the Federal Employer Identification Number. However because of numerous additional.

If you pay a household employee such as a nanny babysitter caregiver or house manager more than 2400 a year or 1000 in a quarter to perform work in your home or occasionally even. 49 average effective rateGas tax. In addition the nonprofit must also withhold.

Employers who pay more than 50000 withholding tax per year are required to pay by electronic funds transfer EFT. If the wage withholding tax due for a filing period is greater than the amount previously reported and paid the additional tax can be reported and paid via EFT online at. If you live in.

Unlike some other states Colorado does not currently have any sales tax holidays. Updated June 2022 These free. Colorado residents who work in another state should be aware of the credit for tax paid to another state.

Generally speaking taxes are calculated on all employee earnings -- bonus payments commission payments earnings for on-call duty and. Colorado tax year starts from July 01 the year. The state levies various.

The following are the fundamental stages for processing payroll in Colorado. The Centennial State has a flat income tax rate of 450 and one of the lowest statewide sales taxes in the country at just 290. Colorado imposes a 290 sales tax with localities charging 475 for 765 percent.

The state income tax in colorado is assessed at a flat rate of 463 which means that everyone in colorado pays that same rate. Employers who do not meet this requirement are encouraged to use EFT. The income tax is a flat rate of 455.

Federal Employment Tax Due Dates If. The IRS taxes anywhere from 0 to 37 of gross wages.

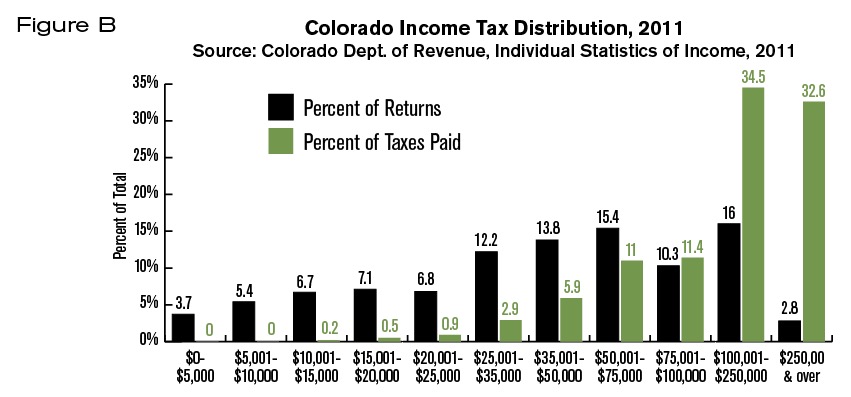

Who Pays Colorado Taxes Independence Institute

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Denver Tax Attorneys Anderson Jahde

Colorado Will No Longer Tax Period Products And Diapers See How Much You Can Save

Colorado State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Taxes In Boulder The State Of Colorado

Colorado Issues New Employee Withholding Certificate For 2022

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Colorado Cryptocurrency Tax Payments Get Paypal Assist 1

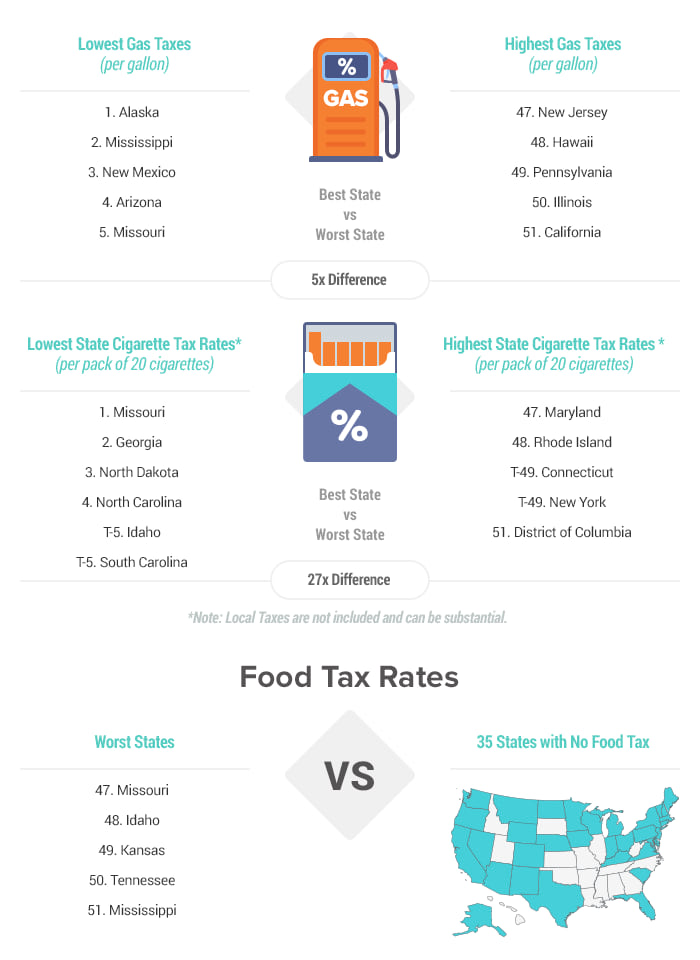

States With The Highest Lowest Tax Rates

A Complete Guide To Payroll Payroll Taxes For Colorado

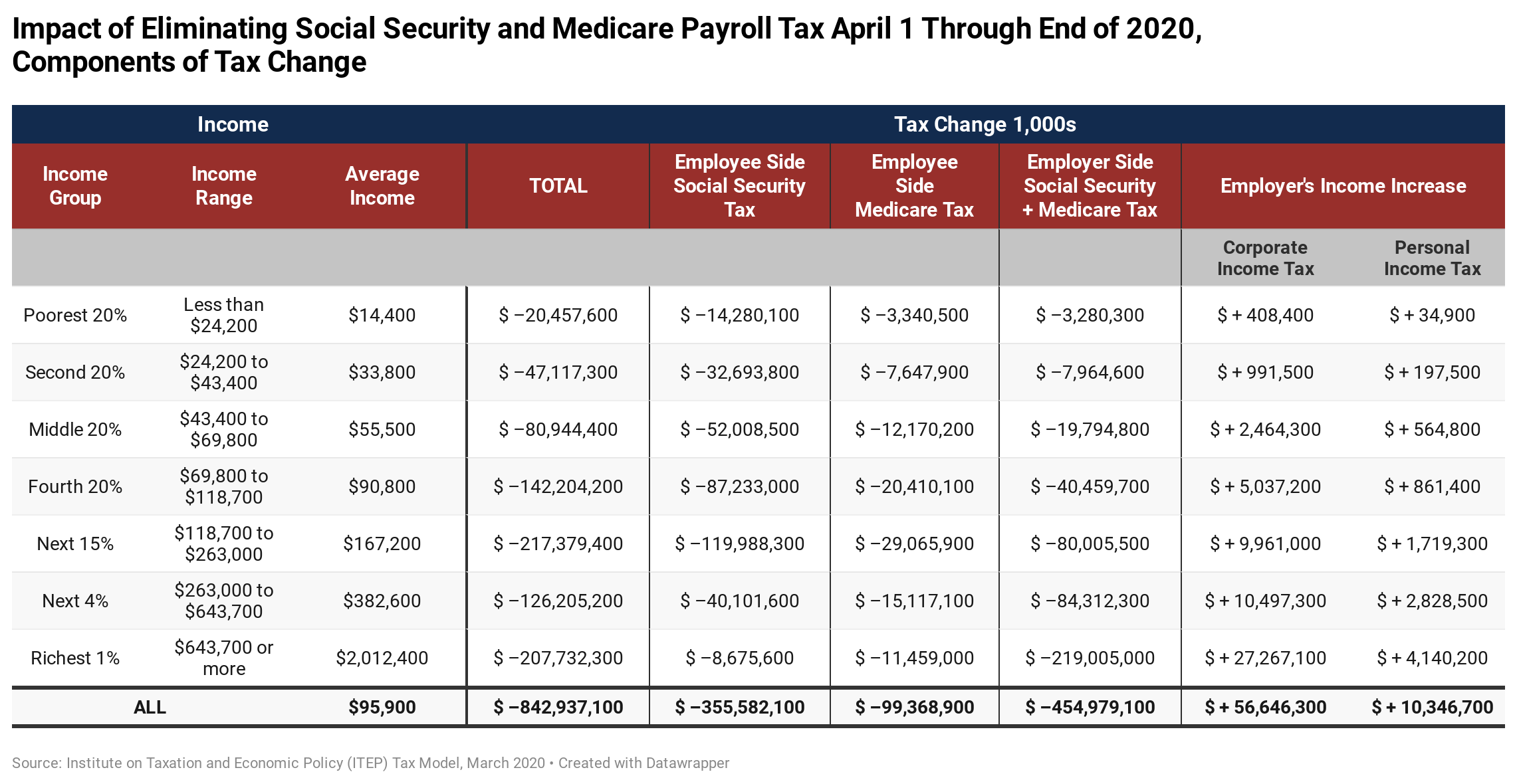

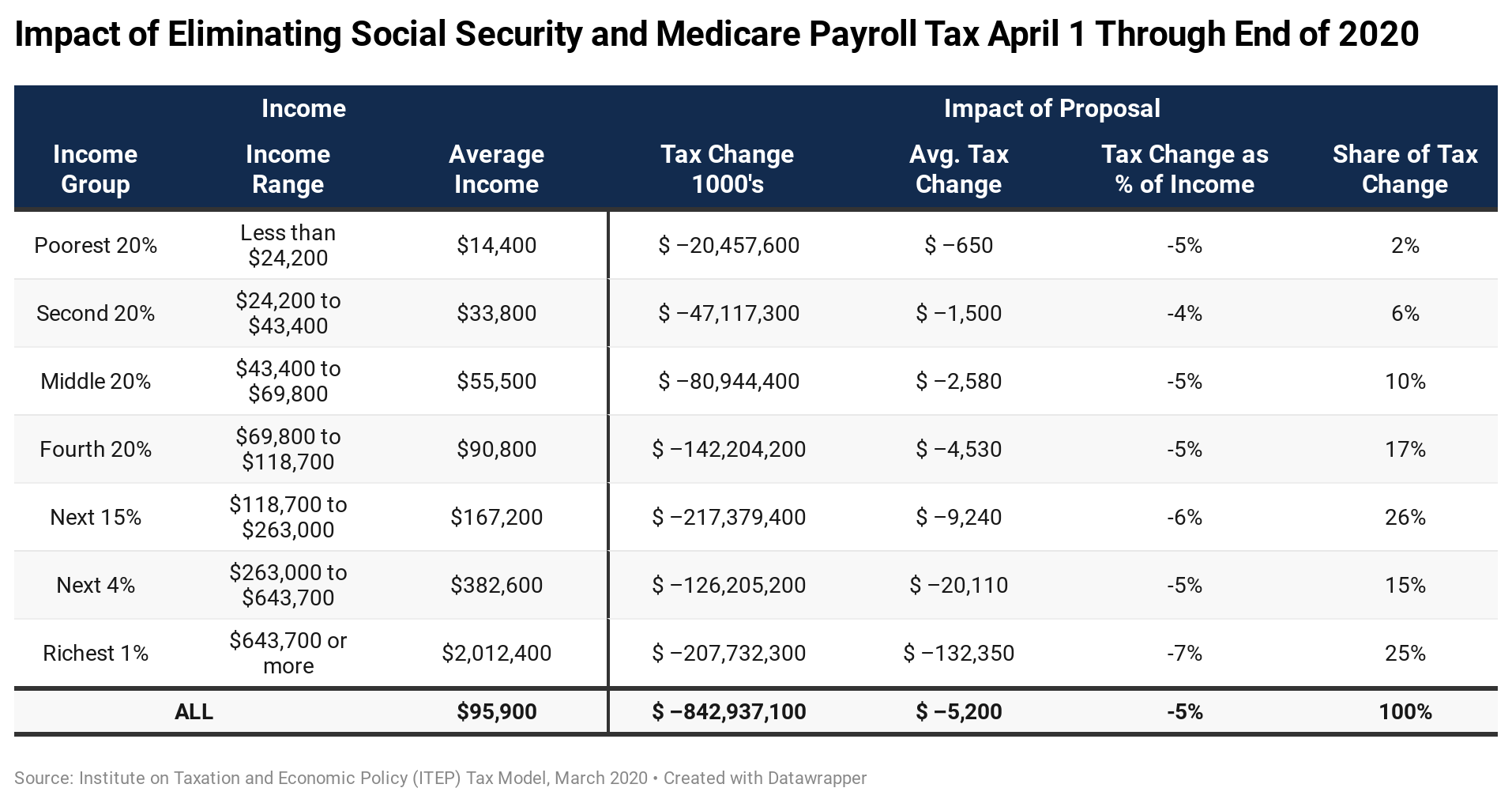

Trump S Proposed Payroll Tax Elimination Itep

Colorado Proposition 121 State Income Tax Rate Reduction Initiative 2022 Ballotpedia

Payroll Taxes 101 What Employers Need To Know Workest

Math You 5 4 Social Security Payroll Taxes Page 240

Here S How Much Money You Take Home From A 75 000 Salary

Register For Payroll Taxes In Colorado Registration Of Sit And Sui

How Do I Register For A Colorado Sales Tax License When Starting A New Fitness Business