what gifts qualify for the annual exclusion

In 2023 the per-person lifetime exemption from estate and gift tax will rise to 1292 million up from 1206 million. In contrast gifts of future interests such as gifts of a remainder interest or other types of delayed interests do not qualify for the annual gift tax exclusion.

Annual Gift Tax Exclusion A Complete Guide To Gifting

Funding the SLAT Such gifts are excluded from gift tax only if they are gifts with present interest meaning that the.

. Under Internal Revenue Code IRC Section. In addition to the lifetime gift and estate tax. The current amount is.

Check all that apply Lucy and Desi have 5 children and. This means that beginning on January 1 2023 an. However the annual exclusion is available only.

Gifts to the trust will be treated as gifts of present interests in property qualifying for the annual exclusion notwithstanding the trustee controls the use of the property in the. My client has a problem. Starting in 2022 currently proposed legislation would reduce the annual gift tax exclusion to 10000 per year per donee recipient.

Each spouse is US citizen. Gifts are subject to a federal tax but an exemption is available to shelter cumulative gifts within the threshold currently 5490000. 2503 an annual exclusion is allowed for taxable gifts the amount of which as adjusted for inflation was 12000 in 2007.

The basic exclusion amount is a combined lifetime gift and estate tax exemption. Cant give spouse a GPOA over the property. As part of the unified gift and estate tax exemption the lifetime gift tax exemption can shelter gifts above the annual exclusion amount from taxation.

1 day agoFor persons planning to make annual exclusion gifts this year the gifts must be completed by December 31. Study with Quizlet and memorize flashcards containing terms like Which of the following gifts qualifies for the annual exclusion. Tuition or medical expenses you pay for someone the educational and medical exclusions.

In 2023 the annual gift tax exclusion amount will increase to. That means that someone with a taxable estate of 12. What are the requirements for gift splitting.

The amount of money that may be transferred by gift from one person to another each year without incurring a gift tax or affecting the unified credit. Gift tax returns In. Do gifts to a slat qualify for the annual exclusion.

The gift tax annual exclusion has been adjusted to reflect increases in cost-of-living expenses following the average Consumer Price Index. Itll also limit the donor to 20000 annual exclusion. Must be married at the time of gift and if spouse dies the same.

However some gifts are outside the taxs scope. It can shelter from tax gifts above the annual gift tax exclusion. Basically this means that any gift with.

She has a 4 million estate and wishes to reduce it to the extent possible using gifts that qualify for the annual exclusion. The main restriction on the use of the annual exclusion is that only current interest donations qualify for the exclusion. The gift tax annual exclusion will increase for the second year in a row rising to 17000 per recipient in 2023 up from 16000 in 2022.

Gifts that are not more than the annual exclusion for the calendar year. Skip to content 480-839-4900. Under current law the exemption effectively shelters 10 million from tax indexed for inflation.

This is currently set as 1206 million per donor in 2022.

:max_bytes(150000):strip_icc()/GettyImages-1127795567-563750f44669468fbf8f303a1dda246b.jpg)

Learn Why Annual Exclusion Gifts Aren T Taxable

Make Gifts That Your Family Will Love But The Irs Won T Tax Henderson Franklin Starnes Holt P A

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

Estate And Gift Planning For 2015 And Beyond

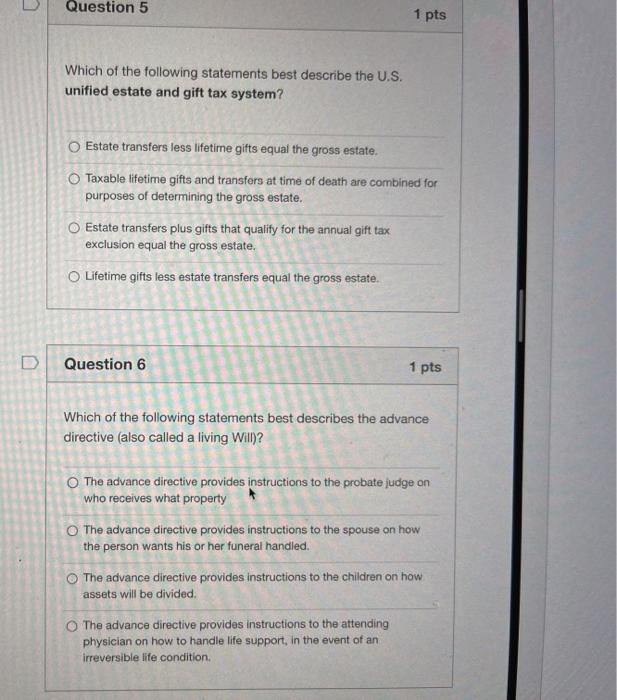

Solved Question 5 1 Pts Which Of The Following Statements Chegg Com

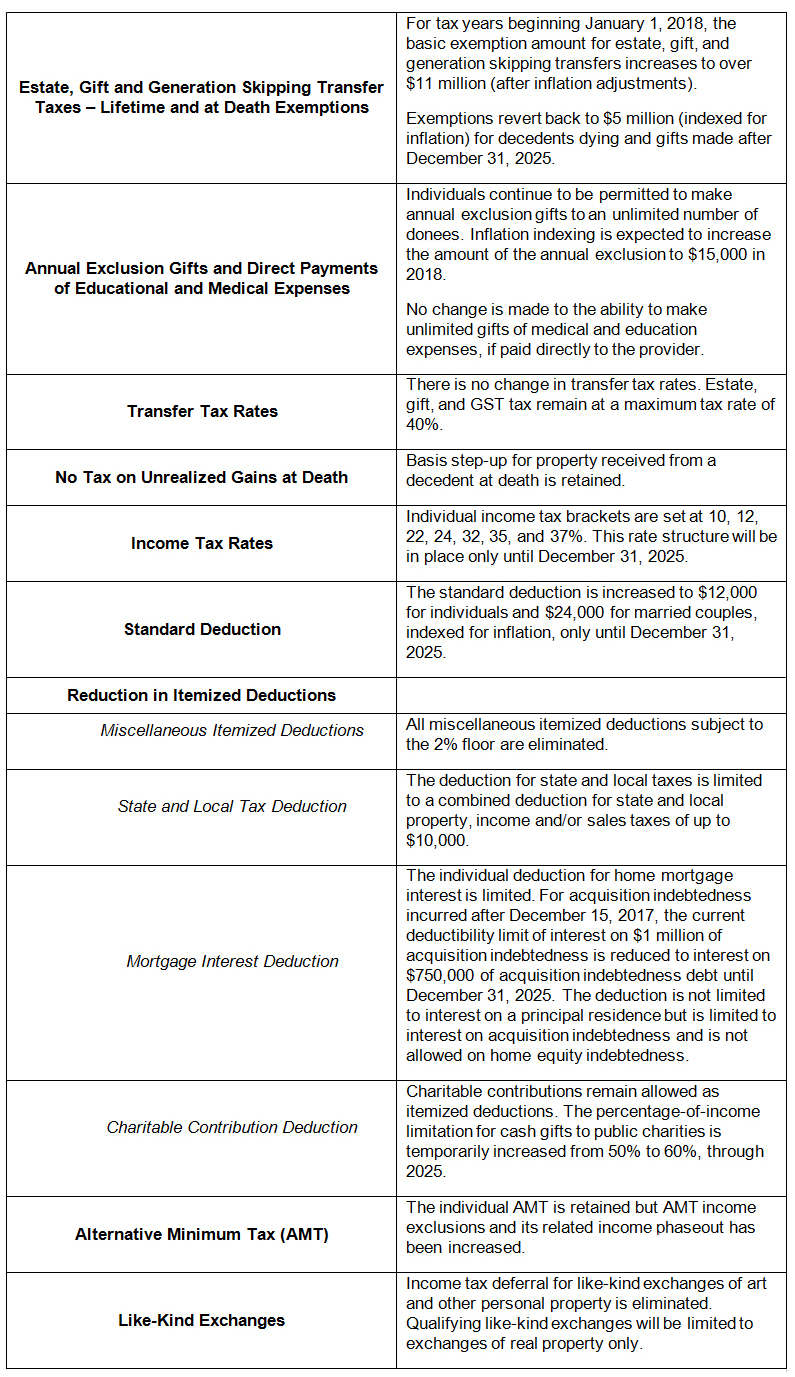

2017 Year End Individual Tax Planning In Light Of New Tax Legislation Steptoe Johnson Llp

What Is The Gift Tax Exclusion For 2017 Cipparone Zaccaro

Annual Gift Tax Exclusion A Complete Guide To Gifting

Year End Tax Planning Gift Tax Exclusion Tucson Phoenix Az

The Benefits Of Making Annual Exclusion Gifts Before Year End Williams Keepers Llc

New Jersey Gift Tax All You Need To Know Smartasset

Annual Gift Tax Exclusion A Complete Guide To Gifting

Gift Tax The Annual Exclusion And Estate Planning The American College Of Trust And Estate Counsel

Annual Gift Tax Exclusions First Republic Bank

The Gift Tax Turbotax Tax Tips Videos

Will You Owe A Gift Tax This Year

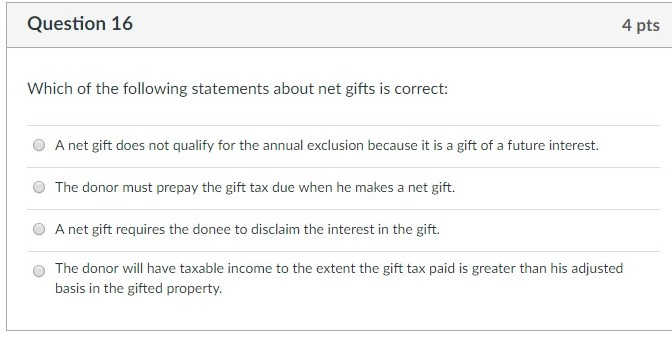

Solved Question 16 4 Pts Which Of The Following Statements Chegg Com

:max_bytes(150000):strip_icc()/christmas-cash--wad-of-american-currency-tied-with-red-ribbon-611319628-ab2093a9addf4a46b6a54817e5eaee21.jpg)